스포트라이트

Chief Financial Officer (CFO), Chief School Finance Officer, Comptroller, Financial Controller, Finance Manager, Corporate Finance Manager, Budget Manager, Finance and Administration Manager

Financial managers supervise and work with other employees to produce financial reports on the performance of their organization. Their work also involves overseeing investment activities, developing strategies for long-term financial growth and advising senior managers on ways to maximize profits, accounting for market fluctuations.

- Successfully implement an activity such as cost reduction, integrating a new system, acquiring a company, etc. which improves the profitability of the company

- Recognition from peers as a knowledgeable person, consultant role, a job of high esteem

- Well-paid and stable job

- Later on in your career, may have opportunities to work from home/for flexible hours

- Career allows you to work flexibly in various industries, e.g. consulting, accounting firm, etc.

Morning:

- Read and respond to emails, which may involve approving/denying requests for investments or expenses, approving invoices, or responding to instructions from upper management to carry out more specific tasks like conducting tax calculations or explaining increase in costs or reduction in sales.

Mid-morning:

- Attend a daily meeting with the management team to get updated on deviations in performance from the previous day and find corrective actions for negative deviances. In these meetings, the business controller gives input on anything related to finance, for example in the event of failure of existing equipment, the business controller will propose the most cost effective way to replace this machinery (e.g. renting replacement machinery instead of buying)

- These kinds of meetings are common to any industry, even a service industry.

Afternoon:

- Various members of the management team (e.g. head of engineering department, head of manufacturing department, head of purchasing department, head of HR) will seek advice on finance-related issues, such as (in the case of the HR department) determining whether the company should invest in a full-time or part-time additional employee, considering the available funds.

- Consulting comprises the majority of a business controller’s job responsibilities, and the type of issues he/she may have to advise on vary greatly from day to day.

- Costing estimation and pricing recommendation is also a regular task, and involves calculating cost of a customer order, determining a good margin of profit and recommending an appropriate price.

Ad Hoc tasks: These tasks are required every once in awhile

- Evaluating the costs and potential profit involved in acquiring a new company

- Calculating the payback of a new investment

- Business plan and quarterly forecast: calculating a financial forecast of projected profit for the next year/next 3 months

- Communicating with bankers and lawyers: e.g. asking for loans, or working with a lawyer to determine the financial implications of a lawsuit against the company, or changing the title of the land, for example

- Business controllers are commonly also charged with securing IT performance of the company: this may involve forming a project team to determine if implementation of a new software or programme will sufficiently improve the company’s performance, for example

- Annual audit: may have to prepare some documents for auditors reviewing (charged with verifying the accuracy of my accounting performance according to accounting principles of the IFRS), according to their request, and make time to answer questions they may have

- Make sure that the property of the facility is insured at the accurate current market value

- Deal with taxes: prepare tax report for IRS once a year, and make timely payments on property tax to local government

End of the month, and annual closing:

- These can be very busy and demanding periods due to strict due dates. In these periods, a typical day involves the additional responsibilities of making sure all financial transactions conducted by the company are recognized/accounted for (e.g. stocks, invoices, accruals, fixed assets appreciation, inventory, accounts payable, accounts receivable)

소프트 스킬

- Communication skills: explain and justify complex financial concepts

- Detail oriented: precise and attentive in preparing and analyzing reports such as balance sheets and income

- Judgment and decision-making

- Complex problem-solving

- Organizational skills: dealing with a range of information and documents

기술 능력

- Analytical skills: assisting executives in making decisions

- Math skills: algebra, and the ability to understand international finance and complex financial documents

- Accounting software: Hyperion Enterprise, Intuit QuickBooks, Sage 50 Accounting, Sage Fixed Asset Solution FAS

- Data base user interface and query software: Microsoft Access, Structured query language SQL, Yardi

- Spreadsheet software: Corel QuattroPro, IBM Lotus 1-2-3, Microsoft Excel

- Service industries: e.g. banking, consulting, teaching

- Manufacturing industries

- Trading industries: e.g. Amazon

- Accounting and financial management is a core position in almost every type of organization

It’s always good to work for a ‘Big 5’ company because they will give you exposure to a great variety of industries (service, manufacturing, etc.), and it’s a good resume-booster

Attaining a CPA qualification is very desirable now, and will give you the possibility in the future to open your own accounting firm

- If you liked math in school, or are naturally gifted with numbers and are detail-oriented

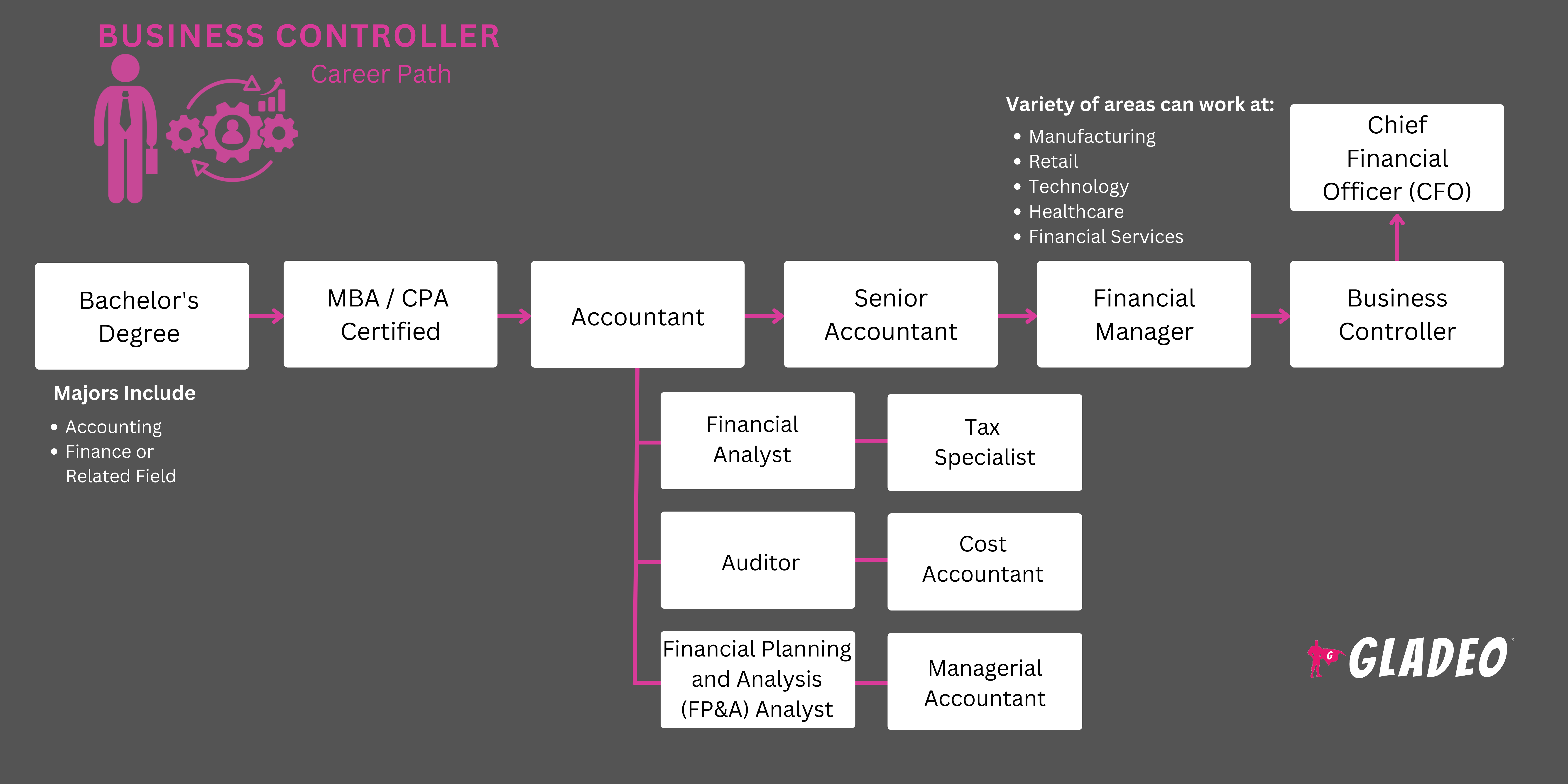

Basic Requirements

- A Bachelor’s degree in finance, economics, business administration, or accounting

- At least 5 years of experience in the financial sector, e.g. as an accountant, securities sales agent, or financial analyst

- Some companies may provide on-the-job training or formal management training programs to help prepare talented and motivated financial employees to become financial managers within their organization

- A Certified Public Accountant (CPA) credential is commonly desired, although whether it is strictly required varies according to the organization

Career Advancement

- A master’s degree, preferably in business administration, finance, or economics. Such a degree can signify superior ability in analytical skills, financial analysis methods and software.

- Many complete the Association of Government Accountants’ Certified Government Financial Manager (CGFM) program

- CGFM requires passing three exams: Governmental Environment; Governmental Accounting, Financial Reporting and Budgeting; and Governmental Financial Management and Control

- Other certifications include:

- The CFA Institute’s Chartered Financial Analyst

- The Association for Financial Professionals’ Certified Treasury Professional and Certified Corporate Financial Planning Analysis Professional

- Also, American Institute of Certified Public Accountants helps Certified public accountants (CPA) qualify for licensure, as needed

- To move up and become a Chief Financial Officer, you may need to complete an MBA or master’s in a financial major

-

Make sure you choose a bachelor’s course that fulfills the required hours in the required classes to qualify for the CPA programme (These prerequisites vary according to state, for example, the California CPA program demands a total of 150 credits completed in your BA degree, with 24 semester hours of Accounting courses spread among specific courses, etc.)

-

Similarly, verify and make sure your choice of a BA degree meets the requirements to pursue an MBA if this is the qualification you will pursue

- Enroll in math, accounting, finance, marketing, and business courses, along with classes to help develop your writing, public speaking, analytics, research, and teamwork skills

- Help family and friends with financial planning and budgeting

- Volunteer as a budget or resources officer with your school or other organizations

- Look for ways to learn common digital tools such as programs for:

- Account aggregation

- Advanced financial management

- Application Integrations

- Client Relationship Management

- 문서 관리

- Workflow automation

- Enterprise Resource Planning

- File sharing and scheduling

- Financial planning

- Risk assessment

- Apply for finance-related intern jobs to gain work experience

- Ask working Financial Managers if they have time to do an informational interview to help you get started on your path

- Download Kaplan Financial’s free eBook on Career Path Stories from Finance Professionals

- Don’t wait to develop a professional network via LinkedIn. Write articles and start working on your reputation

- Always keep your social media professional, because you never know who is looking

- Finance internships are an important way to get the experience you’ll need to qualify for a Financial Manager position. Per BLS, most Financial Managers typically need “5 years or more of experience in another business or financial occupation, such as an accountant, securities sales agent, or financial analyst”

- Popular job portals for jobs in this field include eFinancialCareers, Financial Job Bank, Indeed, Simply Hired, Glassdoor, and the Association for Financial Professionals’ site

- Review job ads closely to screen for keywords and required qualifications. Ensure your resume lists the same keywords and that you meet all minimum requirements to apply

- Be sure to add quantifiable data to your resume, including dollar figures and statistics, along with impacts made

- LiveCareer offers helpful professional Finance Manager resume examples

- If a cover letter is requested, be sure to tailor it to the specific job and share info not already on your resume

- Let your network know you’re looking for a Financial Manager job. According to Forbes, up to 70 - 80% of job openings aren’t advertised. To tap into this “hidden job market,” you’ll need to network

- Be sure to have a rock-solid list of references. Ask teachers, supervisors, and colleagues in advance if they’ll serve as references or write letters when the time comes

- Study interview questions so you can prepare your answers beforehand

- Promotion: starting as an accountant in a corporation, and working your way up the ladder with promotions, to attain the position of Business Controller

- Implement proposed finance strategies in a timely and accurate manner

- Performance and efficiency is key!

- Some companies will provide a mentor to help you, as a new employee, integrate into the company's procedures and policies

- University professors and managers you meet through internships

- LinkedIn’s Business Controller groups: online forums where you can post questions, etc.

웹 사이트

- American Bankers Association

- American Institute of CPAs

- Association for Financial Professionals

- Association of Government Accountants

- Certified Financial Planner Board of Standards

- CFA Institute

- Financial Industry Regulatory Authority

- Financial Planning Association

- Global Academy of Finance and Management

- Insurance Accounting & Systems Association

- U.S. Chamber of Commerce

도서

- Financial Intelligence, Revised Edition: A Manager's Guide to Knowing What the Numbers Really Mean, by Karen Berman

- The Financial Controller and CFO’s Toolkit: Lean Practices to Transform Your Finance Team, by David Parmenter

- Controller’s Code: The Secret Formula to a Successful Career in Finance, by Michael Whitmire

- The Basics of Public Budgeting and Financial Management: A Handbook For Academics And Practitioners, by Charles E. Menifield

- Consultant

- Operations Manager

- Academic field: E.g. Lecturer/TA in Finance and Accounting

뉴스피드

주요 채용 정보

온라인 강좌 및 도구