스포트라이트

Accountant, Accounting Officer, Audit Partner, Auditor, Certified Public Accountant (CPA), Cost Accountant, Financial Auditor, General Accountant, Internal Auditor, Revenue Tax Specialist, Tax Preparer

Accountants and Auditors are responsible for keeping an organization’s finances straight and highly organized. They work with financial records to ensure accuracy and compliance with state and federal law. At times they perform thorough audits to inspect for mistakes and problems.

Due to the fact that almost every organization deals with money, this is a very large profession. A major aspect of this career involves tax filings. Most entities want to keep taxes as low as possible, so they rely on their Accountants and Auditors to follow best practices that will cut costs and maximize profits. This involves an abundance of meetings and reports writing to offer actionable, numbers-driven advice to management.

Overseeing budgets, doing taxes, and conducting audits are only parts of this multifaceted field. That is why many workers choose to specialize in certain complex areas. Roles can be broadly broken down into the following:

- Public accountants/Certified Public Accountants (CPAs)

- Management or government accountants

- Internal or external auditors

- Information technology auditors

- Helping organizations stay operational even during turbulent times

- Ensuring funds are available to keep workers employed and paid on time

- Assisting with finding ways to free capital to invest in growth and development

- Keeping businesses profitable enough to hire new employees and incentivize existing ones, thus helping the economy

- Working with multiple elements within an organization

근무 일정

- Accountants and Auditors work full time, with overtime required during certain periods. In particular, end-of-year actions and tax season can be critical times demanding longer-than-average hours as the workload increases. Unexpected sales slumps or economic factors drive schedules in times of urgency.

일반적인 업무

- Develop operating budgets and projections

- Analyze accounting figures to look for problem areas and discrepancies

- Examine trends, revenue, expenses, and other factors when making projections for decision-makers

- Compare and contrast actual costs versus projected ones

- Review financial statements for accuracy; document and report findings

- Ensure compliance with state and federal laws and guidelines

- Serve as a liaison with external agencies such as the IRS

- Prepare complex tax filings and advise leadership on tax matters

- Consult with organizational members on tax implications for certain actions

- Establish organized records management and accounting systems and practices

- Consider resource management issues that impact the organization’s finances

추가 책임

- Perform thorough audits on a routine basis to review accuracy of figures

- Report problems to management and external agencies when required

- Work with various elements within an organization to ensure funding for their needs

- Travel to work sites, sometimes outside the local area, to conduct observations and meet managers or other analysts

소프트 스킬

- 무결성

- 비판적 사고

- Good oral and written communication skills

- Sharp attention-to-detail

- Analytical problem solving

- Deductive reasoning

- Good vision for reading

- Highly organized

- Independent

- Compliance-oriented

- Desire to improve processes

- Sound judgment and decision-making

- Able to advise and instruct others through verbal and written guidance

- Planning and organization skills

기술 능력

- Knowledge of current accounting and tax software programs, as well as business intelligence and data analysis software

- Familiarity with compliance software tools, databases, query software, and document management systems

- Ability to use enterprise resource planning and financial analysis technology

- Strong math and accounting skills

- Corporations

- Non-profits

- Higher education institutions

- Governmental agencies

- Accounting firms

- Tax preparation and bookkeeping businesses

- Payroll services

- Finance and insurance companies

- Self-employment

Money is at the core of any enterprise. Without sound financial management, no organization can succeed. That is why Accountants and Auditors are critical players in any business or entity they are servicing, with much expected of them.

Working in collaboration with management and leadership, workers in this field are relied upon to ensure budgets are accurate and funds are allocated where needed. They’re responsible for forecasting expenses, finding problems, and offering solutions to get things back on track quickly.

Accountants and Auditors help their employers’ businesses operate efficiently to maximize profits. A large part of that endeavor requires tax expertise, so workers must stay constantly updated on tax policies and changes. They should be ready to offer aid when problems occur, such as external audits, the discovery of embezzlement, a public relations incident impacting sales, or an unexpected drop in production due to worker injury or damaged equipment. There’s no end to the issues that can impact a company’s bottom line at any moment. Thus there’s constant pressure on the financial team to manage risk and have contingency plans ready to roll. Travel, late meetings, and overtime may be required.

The Bureau of Labor Statistics predicts three specific factors will continue to impact this field in the coming years — the economy, globalization, and advances in technology. 2020 saw dire blows dealt to economies around the world. As businesses have struggled to keep employees on the payroll while revenue plummeted, accountants have been put to the test. To prepare for future disasters, they’ll undoubtedly be tasked to come up with contingency plans that include more integration of technology to deliver services and products via online platforms.

Due to the nature of the work, Accountants and Auditors spend most of their days indoors, pouring over numbers and reports and attending meetings. O-Net Online lists this occupation as “conventional,” meaning workers are used to following routines, working with data, and operating under a clear hierarchy with a lot of structure. Persons in this field likely grew up in orderly homes or enjoyed engaging in activities that involved a high degree of solitude. They may not have liked change or disruptions, and so took care to plan for unexpected occurrences that might interfere with their well-organized activities.

This career field does require social traits, as there are often meetings and presentations. However, for some, these are more of a necessity than something to look forward to. In their youth, Accountants may have exhibited competence with public speaking, but the limelight may not have been their preference. They may have been content diving into the details of whatever they’re working on rather than always interacting with others. There could also have been a tendency to focus on following rules, complying with written procedures, and paying mind to those in positions of authority.

- Accountants and Auditors typically need a bachelor’s in accounting or a similar major

- Smaller organizations could potentially hire entry-level applicants with a combination of undergraduate credit and work experience

- Larger organizations may require candidates to possess a master’s

- Workers who file with the Securities and Exchange Commission must be Certified Public Accountants, with a license from their applicable state’s Board of Accountancy

- CPA requirements include 150 semester hours of courses, plus an exam

- Note, some employers may assist with funding this credential

- Certain states allow work experience to substitute for credits

- The National Association of State Boards of Accountancy lists the Top 5 Reasons to be a CPA

- The American Institute of Certified Public Accountants requires the Uniform CPA Exam to be completed in four parts, over the course of 18 months

- Continuing education is usually part of licensure renewal

- Additional optional certifications include:

- Certified Management Accountant

- Certified Internal Auditor

- Certified in Control Self-Assessment

- Certified Government Auditing Professional

- Certified Financial Services Auditor

- Certification in Risk Management Assurance

- Certified Information Systems Auditor

- Accredited in Business Valuation

- Certified Information Technology Professional

- Personal Financial Specialist

- Per O-Net Online, 39% of Accountants and Auditors have “some college, no degree” while 42% have a bachelor’s. 14% possess an associate’s

- Many larger organizations recruit directly from universities, so check with your school or program staff to learn how they can assist graduates with job placement

- Connect with alumni to ask questions about their experiences

- If you’re considering becoming a CPA, look for programs that help prepare for that

- Also consider programs that may offer dual bachelor’s/master’s degree tracks, such as at NYU’s Stern School of Business (offering a dual BS in Business/MS in CPA)

- Accounting is a field suitable for online study, so consider accredited online or hybrid programs if they are more convenient for your schedule

- As a future Accountant, practice your cost-savings skills by hunting for schools offering scholarships and tuition discounts

- Get your own financial affairs in good order, to include tracking your expenditures

- Take college prep courses in accounting, economics, and business in high school

- Gain hands-on practical experience by volunteering for fundraising events

- Serve in student committee treasurer positions

- Learn to prepare tax returns; get familiar with state and federal tax code intricacies

- Become an IRS Tax Volunteer and receive free training

- Discover the treasure trove of free training offered at AccountingCoach

- Catch up on the latest software apps used by modern Accountants and Auditors

- Polish your written communication and oral presentation skills to perfection

- Seek out internships at local businesses

- Write articles related to your area of interest and post them on LinkedIn or Medium

- Read accounting website content and subscribe to newsletters to stay on top of trends

- Accounting internships are a good way to not only gain experience but potentially roll into a full-time job

- Sign up on job portals like eFinancialCareers, Financial Job Bank, Indeed, Simply Hired, Glassdoor, and the Association for Financial Professionals’ job board

- Screen job ads for keywords and required qualifications. Make sure resume conveys the right experiences to match what the employer is looking for

- Include lots of quantifiable data to your resume, including dollar figures and statistics along with impacts made

- Resume Genius offers helpful professional Accountant resume examples

- If a cover letter is requested, be sure it compliments your resume. It should be tailored to the specific job and offer insight into your personality

- Let your network know you’re looking for an Accounting job. Forbes states that up to 80% of job openings are never advertised, so tap into the “hidden job market” be talking to your network

- Ask teachers, supervisors, and colleagues if they’ll serve as references or write letters recommending you

- Study common Accounting interview questions to prep beforehand

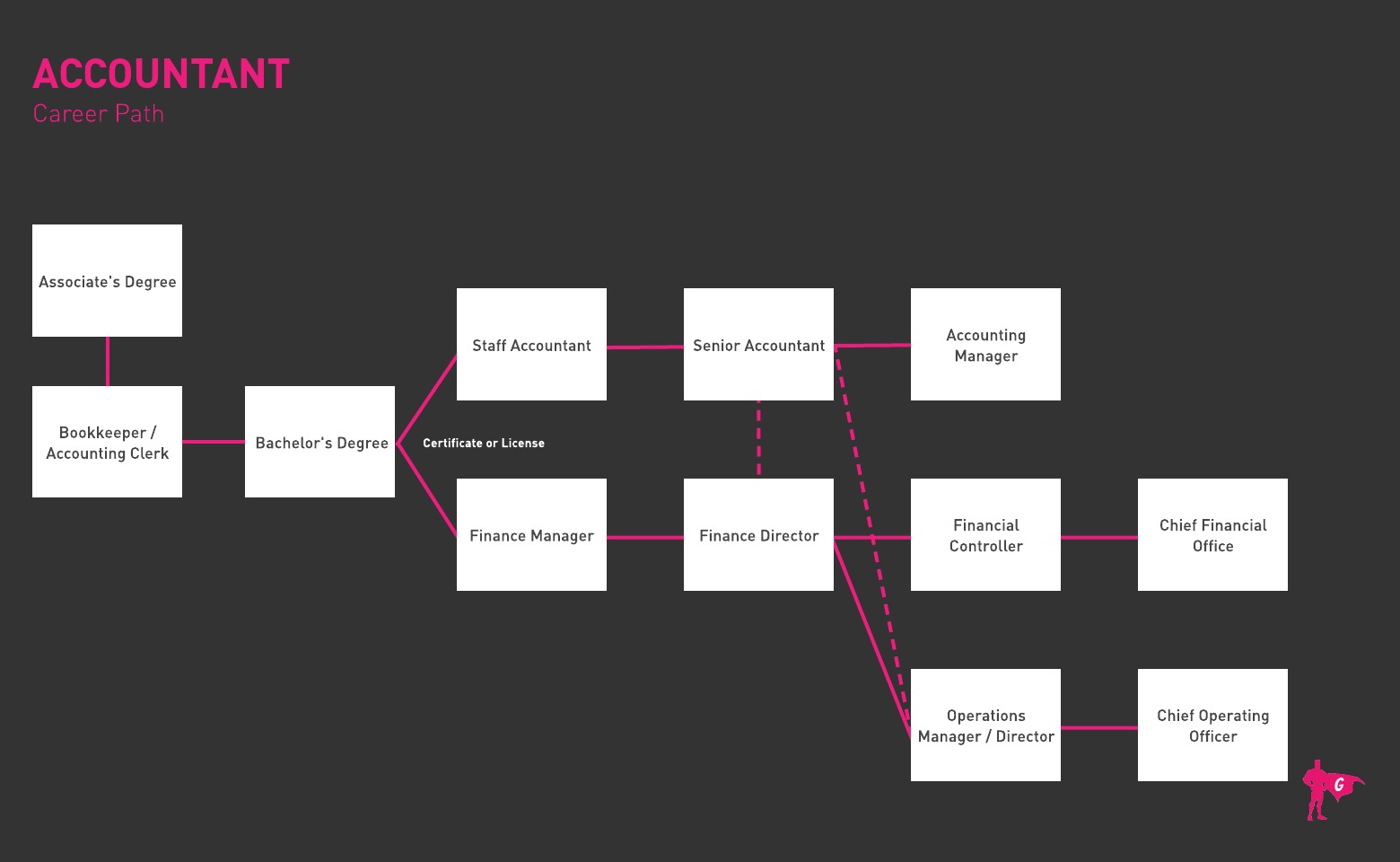

- Know what you want. Decide if you want to be a manager or partner, or move into an executive position for a private firm

- Learn about the different roles and tailor your efforts accordingly. Do you see yourself as an accounting manager, a budget director, a controller, a chief financial officer...?

- Each position has different work and academic requirements, as well as applicable certifications, so set your milestones according to the end goal

- Seek out mentors who can outline the paths for achieving your dreams

- Remember, many Accountants open their own firms and construct their own ladders!

- Pay your dues. Do outstanding work, whether as a cost accountant, junior auditor, or other entry-level roles

- Listen and learn from the senior management and leadership team

- If confronted with challenges, propose in-depth, well-researched solutions

- Display the utmost integrity, professionalism, and competence at all times

- Put your job first, but start working on advanced degrees when the time is right

- Keep up with all state and federal policies and changes related to your area

- Become a tech expert and master all relevant software platforms

- Teach others and help build them into stronger assets for the company

웹 사이트

- American Accounting Association

- American Institute of CPAs

- Association of Certified Fraud Examiners

- Association of Government Accountants

- Association to Advance Collegiate Schools of Business

- Global Academy of Finance and Management

- Government Finance Officers Association

- Institute for Professionals in Taxation

- Institute of Management Accountants

- Insurance Accounting & Systems Association

- ISACA

- National Society of Accountants

- The Institute of Internal Auditors

도서

- Accounting: A Beginner’s Guide to Understanding Financial & Managerial Accounting, by John Kent

- Accounting All-in-One For Dummies with Online Practice Paperback, by Kenneth W. Boyd

- Accounting Handbook (Barron's Accounting Handbook) Sixth Edition, by Jae K. Shim Ph.D., et. al.

- Contemporary Auditing 10th Edition, by Michael C. Knapp

- McGraw-Hill Education 2,000 Review Questions for the CPA Exam 1st Edition, by Denise M. Stefano and Darrel Surett

- Accounting All-in-One For Dummies with Online Practice, by Kenneth W. Boyd

- Accounting QuickStart Guide: The Simplified Beginner's Guide to Financial & Managerial Accounting For Students, Business Owners and Finance Professionals, by QuickStart Guides

- Wiley GAAP 2021: Interpretation and Application of Generally Accepted Accounting Principles, by Joanne M. Flood

The world of finance demands experts in numerous fields other than accountancy. The Bureau of Labor Statics features several suggestions for related occupations:

- Bookkeeping, Accounting, and Auditing Clerks

- Budget Analysts

- Cost Estimators

- Financial Analysts/Managers

- Management Analysts

- Personal Financial Advisors

- Tax Examiners and Collectors, and Revenue Agents

뉴스피드

주요 채용 정보

온라인 강좌 및 도구